What are owners really thinking?

The Superyacht Agency explores how owners are looking to use their superyachts in 2020…

Article from: Superyacht News

Author: Rory Jackson

What are owners really thinking about superyacht activity in 2020? That’s the (multi)million-dollar question. At this point in time their appears to be, at least anecdotally, two different schools of thought. There are those who believe that the 2020 summer season is a total right off and that, therefore, 2020 will become a bumper year for the refit sector. On the other side of the coin, there are those who believe that certain market commentators are premature in believing that the summer season is entirely unsalvageable.

In order to better understand the market’s outlook, The Superyacht Agency has conducted a quantitative research project to ascertain how owners will be looking to use their vessels in 2020.

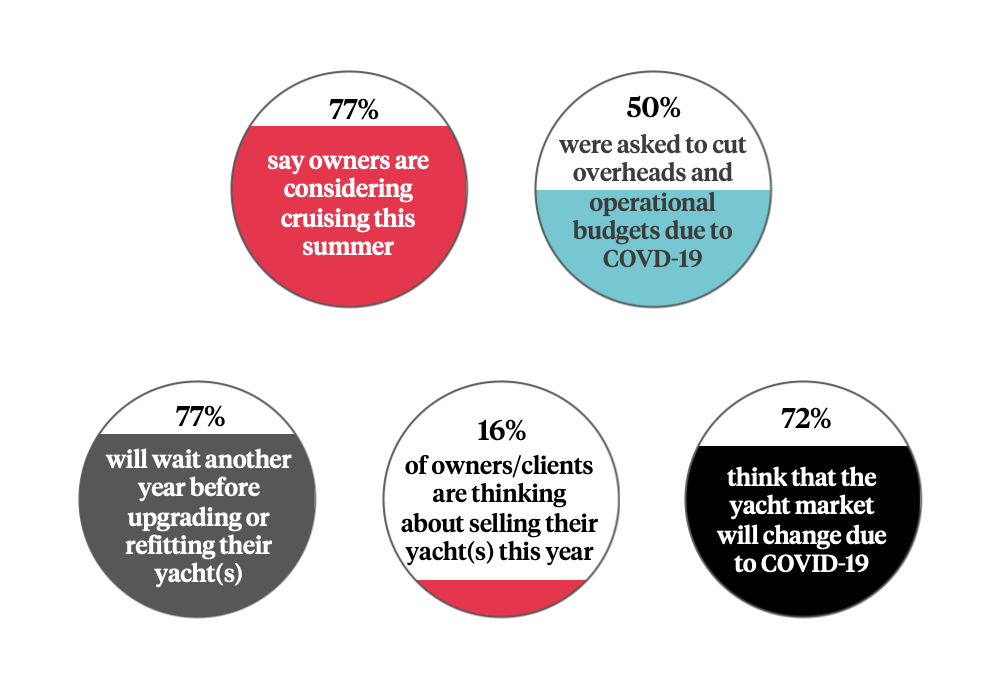

Perhaps the most promising statistic from The Superyacht Agency’s ownership sentiment survey is that 77 per cent of respondents affirm that the owners they are associated with intend to go cruising during the 2020 summer season. To date, there remains a number of questions relating to when certain countries, most notably in Europe, will be open for business and exactly how the market might operate with stricter local restrictions and the continued operation of social distancing measures. Nevertheless, that 77 per cent of the owners associated with the study are considering cruising in summer 2020, bodes extremely well for the industry as a whole.

Of the vessels that do intend to cruise in summer 2020, responses concerning where they intend to cruise were so varied that there was no particular trend to identify. Indeed, the vast majority of responses echoed the migratory patterns that we would expect of a typical summer season, with many still choosing to operate in the Western Med, the Balearics, Greece, Turkey and other popular destinations. However, some respondents did suggest that they would do their best to avoid Italy and France in particular, with others admitting that their cruising plans would be determined by which areas were actually open for business.

When asked if owners were looking to cut overheads, 50 per cent of respondents explained that their owners are looking to cut overheads, with the other 50 per cent indicating that there was no intention to cut overheads. That 80 per cent intend to cruise in the summer and 50 per cent intend to cut overheads raises some interesting questions. Assuming that the ‘overheads’ refer to crew costs, many owners that decide to reduce crew costs may find that, come the cruising season, they may struggle to fully staff their vessels, depending on the state of global travel restrictions.

It has already been suggested vessels that employ high numbers of Australian, South African and New Zealand crewmembers, may be required to hire local European work, with doubt remaining over the ability of individuals from the Southern Hemisphere to return to Europe. Indeed, during the first of a candid webinar series, Marianne Danissen, head of yacht management at Camper & Nicholsons International, implored owners and captains to hold off on implementing cuts to crew costs until the picture of the 2020 cruising season becomes clearer, or else risk having a diminished crew for the reduced season.

Of the respondents, 77 per cent explained that their owners did not intend to refit or upgrade their vessels in 2020, with the remaining 23 per cent affirming that they would be undergoing a period of refit. That the majority of owners do not intend to enter their vessel in for refit may suggest that there is some trepidation around projects that are currently delayed and the likelihood of being able to gain a spot among what will inevitably be a backlog of inventory for yards. That being it said, it may simply be an indication of how eager superyacht owners are to use their vessels once lockdown ends and travel restrictions are diminished. Indeed, it is now widely accepted, as well as being supported by our figures, that there is still a great deal of appetite to go cruising once restrictions are lifted.

Equally, 84 per cent of respondents have indicated that the owner they are associated with has no intention of selling their superyacht in 2020. There has been plenty of suggestion that, on the other side of the COVID-19 crisis, we may expect a surge of vessels being put up for sale and, in so doing, the creation of a buyers’ market due to the inflated inventory. The truth of this theory remains to be seen. However, with the majority of respondents not intending to sell, we can assume that UHNWIs are awaiting a clearer economic picture before panic-selling their assets. Nevertheless, 16 per cent of respondents wishing to sell is not an insignificant number and, at this early stage, may suggest that other owners will swiftly follow suit. If there does prove to be surge in the number of superyachts on the second-hand market, we can safely assume that there will be a corollary trend within the charter market as more owners seek to mitigate costs, perhaps driving down charter values in the process.

Interestingly, 16 per cent of respondents claim that their owner is on the market for a new superyacht in 2020, suggesting that amongst the global economic downturn, there is still a number of active buyers that may be looking to take advantage of stressed build projects, spec builds and a proliferation of vessels on the second-hand market. For interested parties, 2020 and 2021 may prove to be the ideal time to buy. Anecdotally, a number of lawyers and brokers have already suggested that the number of enquiries they are receiving is on the rise, since the initial halt in progress caused by the COVID-19 pandemic.

When asked if and how the market will change as a result of COVID-19, 72 per cent of respondents commented that the industry would change. Rather surprisingly 28 per cent believe that the industry will return to normal once the COVID-19 crisis has blown over – this number is seemingly quite high. Of those who believe the industry will change, a wide variety of responses were given. However, the most notable predicted changes to the market include further protections for the charter guest within the MYBA contract, the onset of a buyers’ market, a ‘slow’ new build market, a ‘slow’ charter market with more last-minute bookings, a booming refit sector, an increase in red tape (especially when cruising internationally) and a greater emphasis on hygiene on board.

While the exact makeup of the 2020 cruising season remains to be seen, it is incredibly promising that such a high proportion of superyacht owners intends to use their vessels this year. Such positivity, one hopes, will go some way towards mitigating the damage done to the industry as a whole. As and when more information and certainty avails itself, the industry will need to work tirelessly to create the best possible environment for owners and charter guests.

The Superyacht Agency is here to meet the demand for superior data-driven decisions in the superyacht market. While the intelligence database forms the backbone of its offering, it is only the gateway to what The Superyacht Agency’s Intelligence team can offer. Thanks to the curation of market data spanning a quarter of a century, the team has market information relating to every sector of the industry at its disposal. Therefore, enquiries that go far beyond the fleet itself can be catered for, which is why we help a diverse range of companies, from investors to OEMs, and shipyards to marinas, to build their business models. Click here to view a sample of the work conducted by The Superyacht Agency.